As a small business owner you are crazy busy. Crazy.

So it’s understandable why some things, especially things that are “far in the future”, get lost in the details.

For many of us, selling our small business is something that we hope will happen someday, and hope is all we do. But we don’t realize the risk that “hope only” approach creates for our financial future.

How much time do you spend nurturing the biggest financial transaction of your life?

Do you think it’s going to happen by accident? Do you think you can wait until you are ready to sell to get “ready to sell?”

Many small business owners think that’s how it works, and the way the business brokers chase you, that must be the way it works, right? The business you have right now must be something you can sell when you are ready.

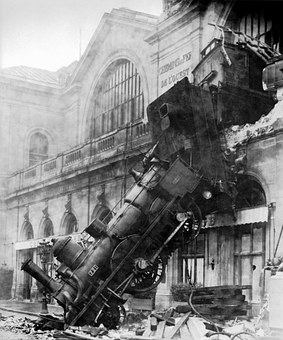

Kerry Hannon’s Forbes article “How Women Entrepreneurs Should Prepare To Sell A Business” hits on some realities that many of us don’t know, or ignore, as small business owners. But when we pay attention, we can hear the warning whistle on the train that’s tearing down the tracks towards us.

A recent Investor Watch report ‘Who’s the boss?” by UBS Financial Services found that 41% of business owners expect to exit their business in the next five years. Many are at, or approaching, traditional retirement age and ready to start a new chapter in their lives. Some simply believe current economic conditions will boost their chances of selling at a favorable price.

The 41% of owners that expect to sell might make you a little nervous. It’s set us a scenario for a crowded market. But you should be even more concerned when you compare those figure to the number of businesses that actually sell. Hannon continues:

For many entrepreneurs, “the business is their retirement plan,” David Deeds, the Schulze Professor of Entrepreneurship at the University of St. Thomas in Minneapolis, told me when I interviewed him for a column on retirement plans for small business owners. “The plan is that when they retire, they are either going to transfer the business to a family member in exchange for a share of future wealth or a buyout or they are going to sell it off and turn that into cash.”

Is that your plan? If so, when do you “plan” to start working on making that plan possible?

“I recommend giving yourself at least two years and preferably a five-year time frame to make a plan.”

So many business owners, both men and women, believe they can sell in a year or less, but we run into a lot of obstacles based on what I call the ‘state of owner readiness.’ The more planning you have done ahead of time, the greater control you can have on the sale process.

I’ve seen the real tears and despair as business owners realize that they are never going to sell their small business. As they realize that their retirement plans were only dreams, they never took the steps to make their business sell-able.

Don’t let your dreams get lost in the details.

You are crazy busy. Make sure some of that busy is dedicated to your own financial future!