Who says selling a small business needs to be hard, or expensive, or take a long time?

After three years of ownership it was time to get rid of a small business I owned. Purchased as a turn-around, the work was paying off. The results had improved and I was ready to test the market.

I placed a free ad on Craigslist:

I advertised the carwash at $250,000 as the property cash-flowed at that price. Selling in the fall would mean I could avoid managing a water-based business through another brutal Wisconsin winter. Where everything freezes. I mean everything.

Have you ever had to use a hair dryer to thaw out a bill acceptor?

Given its location (small, rural town), I wasn’t anticipating a lot of interest from my free ad, but I was pleasantly surprised to receive 10-15 inquiries (including one guy who wanted to buy my business with no money down). So, a decent amount of interest, but no real heavy bites on THIS business.

(I did end up selling this turn-around business, and profiled that journey in this video.)

Steve Shows Up

Then I got an inquiry from “Steve”. Below is the actual email exchange:

Steve sees the ad and emails me:

Where is the location.

I respond:

Thanks for your interest. The property for sale is: XXXXXX (address provided)

I’m happy to provide financial information; however, I am asking prospects to prove they are serious by at least visiting the property before I provide anything additional. If you want more information, email me the code from the sign posted on site at the car wash. (Between the car wash bays is the door to the mechanical room. Above the door is a sign posted with an “Info Code”). Email me that code and I’ll send you more information on financial performance, etc.

(Side note: I’m quite proud of this little trick. I used it to limit time wasted on “web-surfing-only-tire-kickers”. Rather than provide additional financial information to people who weren’t even willing to go to the property in person, I posted a sign with a code on a wall at the property. Prospects interested enough to travel to the site, and email me the code, got the information packet I had prepared. Those who didn’t care enough to make the trip didn’t get to see behind the curtain.)

At this point I did a little research on “Steve” the prospect. Even from the limited information provided in the Craigslist’ email response (supposedly anonymous), with a simple Google search I was able to determine that Steve was likely a small business owner (in town ABC) located about an hour from the car wash mentioned in the ad. Given the distance, it seemed unlikely that Steve was going to be a real prospect for this property; however, I happened to own another, 3X larger facility in the town where he lived and worked.

At this point I did a little research on “Steve” the prospect. Even from the limited information provided in the Craigslist’ email response (supposedly anonymous), with a simple Google search I was able to determine that Steve was likely a small business owner (in town ABC) located about an hour from the car wash mentioned in the ad. Given the distance, it seemed unlikely that Steve was going to be a real prospect for this property; however, I happened to own another, 3X larger facility in the town where he lived and worked.

So, I followed up:

Quick follow-up, I also have a car wash located in ABC in case that’s a better location for you.

He responded:

That’s a little closer

He responded again:

I would be interested in the one in ABC.

He responded a third time:

Please send details and address

I replied:

Property in ABC is: (I provided Facebook page of that facility)

I don’t have an asking price for this one but could put something together if you were interested.

He responded:

I am interested.

My reply:

I’ll pull together some info. I’d ask we make quick introduction, so we know who we’re each dealing with.

My name is: Mike Finger

(The conversation continued from there.)

Quick and Easy

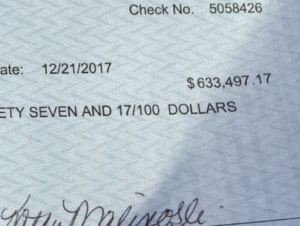

The emails above were sent over 4 hours immediately after Steve responded to the advertisement. 48 days later we closed on the sale of the un-advertised, un-listed business.

Here’s a picture of the check from Steve’s banker:

After closing costs, taxes, fees, settling AP, etc. that was what I deposited. Do I need to mention the smile on my face when I did it?

This is the easiest and cheapest way I have ever sold a business. There might be faster ways to do it, but not many.

- 48 days from first contact to close

- No marketing or advertising

- No broker’s commission

Would you like to do the same thing?

Why Did this Happen, and How Can You Do It?

Can you sell a business the same way? No and Yes.

Obviously, it was a coincidence that I owned a 2nd business in the town where Steve lived. It’s unlikely that you’ll have the same set of circumstances, so you probably can’t match this scenario.

And you might even be thinking . . .

You just got lucky.

If that’s what you think, I can only say, “not true.” I earned this quick and easy sale, and so can you. This sale didn’t happen because of Craigslist, or even because of Steve (although it couldn’t have happened without him), this sale happened for two main reasons . . .

#1: My business was ready to sell.

The business Steve purchased from me was ready to sell before he and I started talking. Even though I hadn’t advertised or listed the business for sale, it was ready for a buyer. I was 4 years into a 5-year plan to turn-around and sell the business that Steve bought. All the decisions I made during that time were designed to create a business that would allow me to take advantage of an unexpected opportunity to sell.

I was ready for this sale, and more importantly, the business was ready for sale. It was all about the results. Which means it had. . .

These “3-D’s” of the results meant I was able to take advantage of the unique opportunity that occurred. Sure it was a fluke that Steve and I connected the way we did, but everything after that went accordingly to plan. When Steve looked at the financials, asked questions about operations, learned about the team . . . on all fronts the business was ready. Not perfect, but ready.

These “3-D’s” of the results meant I was able to take advantage of the unique opportunity that occurred. Sure it was a fluke that Steve and I connected the way we did, but everything after that went accordingly to plan. When Steve looked at the financials, asked questions about operations, learned about the team . . . on all fronts the business was ready. Not perfect, but ready.

So, while it is surprising that the deal initiated the way it did, it’s not surprising that a deal happened. The business was ready, and that’s most of the battle, and that’s a battle you can win as well. But it was also important that . . .

#2: I had a realistic expectation of value.

The price I initially asked for the business (about $750,000) was realistic because I knew a buyer could afford to pay that based on the seller’s discretionary earnings the business generated.

Steve and I settled around $700,000, and the business cash-flowed even better for him at that price. Any buyer could meet their basic needs at that price. That made it a buyable business. The realistic price, combined with the readiness for sale, made it possible for me to turn a coincidence into a nice check to deposit.

Why Did I Tell This Story?

Am I bragging? Trying to pump myself up? Hardly. Any knowledge I’ve gained in this area comes with an ugly backstory. My journey to this place is one with a painful, expensive learning curve.

- I started by making all the embarrassing basic mistakes you can make, and by having the most dangerous of assumptions.

- Over the last 25 years I have watched small business owners miss out (like I almost did). They work for years, sometimes decades, only to come to the end of the road and find they have nothing. And they have nothing because as owners, we wait too long to engage this topic. We wait and then we fail.

- For a long time, I thought selling a business was about luck (and it helps to get lucky).

- Then I thought it was about picking the right broker (and it helps to pick the right broker if you go that route).

- Now I realize one overwhelming truth. Being able to sell your business is up to you, not someone else. It’s about the business you create and the work you do to prepare that business for sale (before you ever want to sell it).

Don’t Exit Plan

A lot of small business owners reject the idea of planning for their exit. I understand the hesitation. Planning for a scheduled, targeted exit can be overwhelming, and seem futile when you’re unclear about what tomorrow will bring to your small business.

For too many of us an exit is too far away to connect with mentally, let alone plan for.

So, fine, don’t plan for your exit. Don’t target a specific date, or dramatically change how you run your business with some future, unclear, departure in mind.

Exit Prepare Instead

Trying to sell an unprepared business, with a free ad on Craigslist, will almost certainly end in disaster. But an unprepared business is equally hard for a broker to sell.

But the biggest benefit of being prepared to sell your business has nothing to do with selling your business.

Being prepared to exit will absolutely make your business easier to own. I mentioned above that I was on a 5-year plan to exit the business Steve bought. That is true. But I also knew that I might own that business for the next 15 years. And that was OK, because . . .

- My business results were desirable to a buyer, which meant I was able to benefit from those results when I was the owner.

- A buyer could duplicate my results, which meant the business wasn’t dependent on me. I had more freedom and flexibility because of that.

- I could document my results, which meant I had quick access to the information I needed to make good business decisions.

These preparations made it easier to own my business and made it possible to sell the business when an unexpected opportunity came along.

Those opportunities do come along, and they come from weird, unexpected places.

Who knows, maybe there’s a Steve in your future.

Will you be ready if he shows up?

Will your business be ready?