It seems like this should be an easy question to answer. It is not. In fact, it’s nearly impossible. That should scare small business owners, since 78% of small business owners plan to sell their businesses to fund their retirement.

But by any measure the news isn’t good for small business owners who want to sell.

Around 20% Sell Their Business

The highest estimate I could find online was at the seemingly outdated site: www.howtoplanandsellabusiness.com.

The site references the 15th edition (that’s 18 editions’ ago) of The Business Reference Guide by Tom West. It calls out the following estimates of sales from the Reference Guide for the smallest of businesses:

Level One – Sales under $500,000 and fewer than 4 employees. Tom estimated that only 20% of these businesses will ultimately be sold.

Level Two – Sales of $500,000 – $1,000,000 and 5 – 9 employees. Again, Tom estimated that only 20% of these businesses will ultimately be sold.

Level Three – Sales of $1,000,000 – $2,500,000 and 10 – 19 employees. A little better, but not much. Tom estimated that only 25% of these businesses will ultimately be sold.

See full Article

But that’s Old Information, the Newer Data Must be Easier to Understand

Actually, it’s worse.

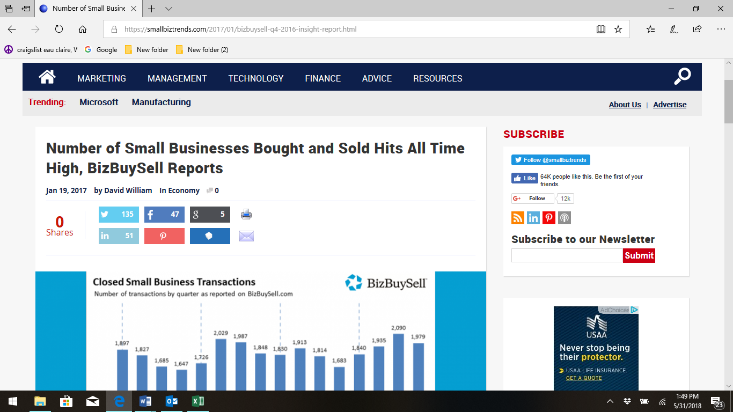

The most referenced data source online in recent years about the sale of small businesses has been the quarterly BizBuySell Insight Report. The report is very interesting, but as you read it, keep in mind how the information is generated.

Closed transactions are reported to BizBuySell.com on a voluntary basis by business brokers nationwide.

Business brokers voluntarily report the transactions that create this report. It’s anyone’s guess what limitations that creates for the data, but the data collection isn’t the concern. The concern is how the report get’s picked up and shared in articles. Like this Inc. article announcing a dramatic 26% increase in the number of business sales.

Many, many articles that use this data will use it to hype the market. They will highlight the “huge uptick in the number of small businesses bought and sold”, using the Insight Report as evidence. This particular article announcing the huge 26% increase points out that . . .

The company counted 9,919 sales, up from 7,842.

You read that right, that’s 9,919 sales, out of 33.1 million U.S. businesses. If that number is even close to accurate, then the 20% estimate for businesses that sell, used above, is exponentially high. Small business owners should be terrified if this is accurate. But it’s not accurate. No one believes that number represents all the businesses sold that year. But no surprise, many brokers are happy to use the 26% increase in the number to build excitement about selling a business or buying one.

This small slice of broker volunteered information is used to define the entire market.

What About a business that is Sold Privately?

I sold a business that wasn’t included in that 9,919 number. Many transactions never touch a broker or a site like BizBuySell.com that might end up reporting the transaction, even informally.

I’ve seen online sites that claim that only 20% of the small business sales that occur each year happen through “professional channels.” (I’ve never seen a source for this claim. It’s interesting how often the number 20% pops up in statistics about small business sales). But even if we use that 20% number and extrapolate from BizBuySell’s figures, it would means that only about 50,000 businesses sold successfully. That’s .1% (point one percent) of businesses.

Why is the Data so Bad?

Small business transaction information is not readily available because it is not required to be publicly reported. . . . “ (BIZCOMPS)

There are a handful of businesses that track and analyze information on the sale of small businesses. They do this as a service to business brokers, valuation companies, etc., so those professionals can better understand the value market for small businesses in different industries.

But even the firms that make their living from this data call out the difficulty they have finding information. Take the following from the user manual for BIZCOMPS, one company that provides business sale data.

Historically, market data on small business transfers has been virtually nonexistent, leaving the investor or adviser to speculate about the fair market value of the enterprise. . . .

The BIZCOMPS® studies are an invaluable resource to the investor or adviser to small business transactions. The studies contain detailed information on over 12,424 transactions from January 2006 through December 2017.

Did you catch that? BIZCOMPS uses 12,424 transactions (accumulated over 11 years) as its data set. Again, that’s out of 33.1 million U.S. businesses. (Please note that we’re not making any judgement about the value or accuracy of BIZCOMP’S data. We’re simple pointing out the limited amount of data available, even for professional firms in this space.)

What are the Odds that You Will Sell Your Small Business?

The answer is – no one seems to know for sure. There don’t appear to be any good, definitive numbers to answer that question. The numbers that do exist show that small business owners who want to sell their business will find the odds are against them. A one out of 5 chance at best.

The Good News

Here’s the good news – your ability to sell your business has nothing to do with how many other owners are able to sell their business.

It has everything to do with whether you’ve built a business that someone else will want, and be able to buy.

Learn to Leave.