If selling a small business is such a long shot, why do so many advisors want you to waste your time? They must, because they keep offering tools and techniques that will never help you sell your small business.

Whenever I see someone offer these “good” tools I think about a scene from Apollo 13.

During most of the movie, the Apollo 13 astronauts are speeding through space to certain doom, and the ground crew is frantically trying to come up with a solution that will allow the travelers to use their broken ship to come home.

There’s a well-known scene where a NASA official proclaims dramatically “failure is not an option”, but that’s not the scene I keep thinking about.

I see the lesser known scene where Gary Sinese’s character has joined the effort to find a solution. He’s going to be working with all these crazy smart people to help figure out how to bring the space travelers home. As he climbs into the ground-based simulator at NASA a well-intentioned helper hands him a flashlight.

He quickly hands it back, along with a slight reprimand.

That’s not what they have up there. Don’t give me anything they don’t have on board.

(You can see the scene at the 3:00 minute mark. Watch from the beginning of the clip to get the “Failure is not an option” build-up.)

Don’t Give me Anything They Don’t Have on Board

It’s certainly not a groundbreaking scene, or a famous quote, but I’m attracted to the pragmatism of the comment.

- We have a problem.

- We need to solve it.

- The guys up in space can only use certain tools.

- Let’s not confuse the issue by working the problem with tools they don’t have available.

Don’t give me anything they don’t have on board.

It’s just a movie, but I always felt the scene captures a simple but profound truth: it’s easy to unintentionally complicate the already difficult challenges we face in the world around us.

Time is wasted working with tools, resources and information that can’t be applied to the problem at hand. I know this runs counter to the “keep learning about everything” approach, but in a world of unending information where we always have newer, better tools available, the real challenge is limiting what we put in front of ourselves. We must control the solutions we consider for our problem, or we will always be solving, and never be solved.

Don’t give me anything they don’t have on board.

It means work the problem, but do it with elements that can be part of the solution. In other words: stop giving me tools that I can’t use to solve my problem.

It’s the simple lesson from a little scene in a big movie.

Now, Picture a Different Scene

You’re the average small business owner, speeding towards almost certain “sell a business” doom. (At least that’s what the odds say).

Failure is the most likely option. You might say it’s a “moon shot” or at least a long-shot for the average small business owner to sell their business. So, you have a problem. You need a solution. Let’s see what sort of tools you’re handed.

Take the article: The 6 Types of Buyers for Your Business

(FYI, I picked this entrepreneur.com article at random after it showed up in my LinkedIn feed. It’s a simple example of standard “sell your business” content. I could literally have picked one of a thousand others like it. I don’t know the author, and I’m sure this article was written with the best of intentions, but that doesn’t change the problem.)

Here’s an article that tells you that . . .

There are six common buyers you will likely encounter as you market a business for sale.

According to the article those likely buyers are:

- Strategic Buyers

- Private Equity

- Family Office

- Holding Company

- Search Fund

- Your Employees (ESOP)

That’s the list of “common” buyers they provide. What’s the problem? Let’s take a quick look at a few of the solutions to see if these are tools the majority of business owners can use.

Your Employees (ESOP)

How many of you have heard of an ESOP?

ESOP = Employee Stock Ownership Plan. An ESOP is a . . . wait. Why do you care? Is this a tool the average business owner should spend any time exploring? Do you know how many ESOP’s there are in the US?

6,482 according to the National Center for Employee Ownership.

Don’t be confused. That’s not 6,482 new ones per year. That’s 6,482 total (as of 2019 data)!

So, with around 30 million companies in the US, that means that .022% of companies are ESOP companies. Not 2%. .022%. Total.

If you meet a business owner you can feel comfortable telling them with confidence “You will never sell your business through an ESOP”. You’ll only be wrong .022% of the time.

Why do business owners need to know what an ESOP is?

Private Equity

From the Entrepreneur.com article:

PE executives bring the financial resources and the corporate acumen to take your operations to the next level, and in many cases they will retain company owners and operators for on-the-ground expertise, making them a great option if you’d prefer to retain a piece of your equity stake. Selling to a PE firm is a great way to help your business realize its full potential.

Fabulous. Why wouldn’t I want to sell to a PE firm? I want my business to reach its full potential. It sounds great. Maybe that’s why it was included in this list.

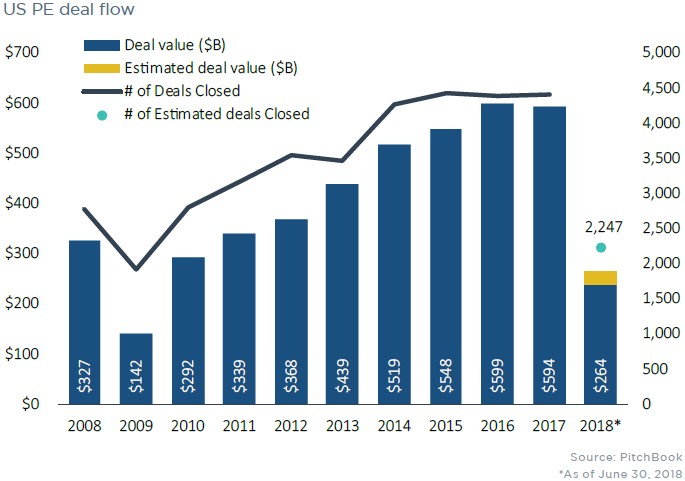

It sure wasn’t included in the list because it’s a likely way for you to sell your small business. How many PE deals get done per year in the US? Around 4,500 according to pitchbook.com.

There you go, that’s another opportunity for .015% of U.S. business owners each year. Oh, and what type of companies are getting deals through PE? According to Pitchbook, 70% of the deals are over $100,000,000 in size.

PE is not a tool you can use. Yet that doesn’t keep it from being pitched all the time – like this email promotion that showed up in my in box:

If you’re looking to sell a small to mid-sized business these days, one of your bidders is likely to be a Private Equity Group.

“One of your bidders is likely to be . . .”? In what universe?

Again, feel free to tell any business owner you meet, “you will never sell your business to private equity”. You’ll almost certainly be right.

Family Office

This one hardly seems worth the effort.

The Family Office Exchange estimates around 6,000 family offices exist in the US. How many buy small companies? Who knows? How many small businesses were bought by these family offices? No idea, but it’s got to be a ridiculously low number.

Enough bashing. You get the point. For the average business owner reading the “6 Buyers” article is a waste of time. And worse than the wasted time, what if a sincere reader steps away from the article with the belief that they now understand the six types of buyers for a business?

- Nowhere does the article say, “for businesses with $100,000,000 in revenue and EBIDTA of $10,000,000+”.

- Nowhere does the article (or the email pitch) say anything to recognize the minuscule market for the opportunity being represented by these solutions.

According to them, it’s “likely” these are the buyers for your business!

The Right Tool

Remember, I’m not saying these tools aren’t good tools. They just don’t apply to the average business owner, and that makes them terrible tools for the majority of us to explore or try to use to try to sell a small business.

What doesn’t the article linked above include? For one, the article doesn’t say, the most likely buyer for a business is an individual. Like you. That’s who you will probably sell to if you sell, but only if your business meets their needs.

So for most owners, the information in the article above is completely unnecessary. For most, these tools will never, and could never, be utilized. They will only waste your time and make the topic more confusing.

But then, given how easy it would be to point out how few use these solutions, it’s almost as if articles like this are designed to confuse and complicate the topic. That couldn’t be true, could it?

Are They Being Intentionally Cruel?

For me, I don’t think producers of this content are being purposely cruel. It’s just them marketing to the client they really want (and that’s not you and me).

The “sell a business” industry is defined by complexity. People get paid to “do deals”, and that often involves complicated components. The larger the deal, the more potential complexity – and the more money for the people helping with the deal.

So, professionals in the industry produce content that highlights their mastery over a variety of convoluted technical areas. They produce articles, videos, and lists (they love lists) that highlight their command of these thorny issues. They hope you’ll see their article, and go to them when you need help understanding this “complex” topic (the same topic that they’ve helped make harder to understand). Worse than the articles, many owners have their first introduction to the “sell a business” topic through a three hour seminar focused on one of these minimally used, highly technical tools.

These obscure, expensive, low percentage, hyper-technical solutions are sold as “common”. These are solutions that are remarkably unimportant to most business owners. But if you’re one of the few businesses that can use these tools, the advisors can make a lot of money if you pick them, so that’s what they offer.

Welcome to the small business owner’s “sell a business” reality.

What’s the Big Deal?

The big deal is that these obscure alternatives, consistently presented as standard fare, confuse, complicate and often crater an already difficult problem-solving challenge for the business owner.

They ask you to focus on the complexity of this topic, instead of helping you see the basics that are likely to keep you from selling your business.

The average business owner is overwhelmed by work and responsibilities. Add to that the challenge of figuring out how to sell a business and the load is back-breaking. How does handing you a tool that applies to .022% of business owners help? Yet much of the content in the “sell a business” space is graffiti-ed with these obscure, minimally used, complex options.

Can we agree that a lot of the “sell a business” content is broken for the average small business owner?

Small business owner beware – the tools they are offering you will make your “moon shot” attempt to sell your business impossible. It’s hard enough to sell a business, but it’s even more so when they keep handing you the wrong tools. Maybe it’s time for the “sell a business” industry to embrace:

Don’t give me anything they don’t have on board.

It’s certainly time for a simple approach.