“She’s so slow!” Tracy shouted over the phone.

“Three months. I’ve been waiting three months to get the financials from her. Why won’t she move faster?”

For Tracy it’s frustratingly simple.

She might want to buy Sue’s business, but every time she tries to make progress on the deal, Sue drags her feet.

Sue always needs. . .

- More time to pull the information together.

- Another week to schedule a meeting with her accountant.

- “Just a few more days.”

“What’s going on?” asks Tracy. “I need the information to figure out if I’m interested in the business. Does she want to sell or not?”

Buyer’s move fast, and sellers move slow. . . at least that’s an easy conclusion to draw if you’re watching buyers search for a business to buy.

Fast and Furious

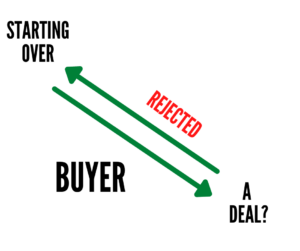

The hunt for a business can be an exasperating exercise in unrewarded speed for early-stage buyers.

Hour after hour scrolling through page after page of business listings.

“Nope. . . no. . . nope. . . maybe . . . nope.”

Buyers jump out to look at a deal, evaluate it, reject it, jump back, and start all over again. Even those listings that make it past an initial look usually end up falling short in a next level review.

Because of all those rejections this early search period is about being fast, fast, fast. And many buyers will tell you the desire for speed is often frustrated by slow sellers.

That certainly is how Tracy sees it.

While she’s trying to speed towards a decision to buy, it seems Sue the owner can only stutter step forward.

Tracy wants to know why Sue won’t move faster.

But what if it’s Tracy, like most buyers, that are really slowing things down?

Speed vs. Velocity

Consider for a moment simple definitions of speed and velocity.

SPEED:

Speed is the measure of how fast something moves. Said another way, it is the distance covered in a certain amount of time.

Example:

You averaged 97 MPH on the racetrack. That means the car you were driving went 97 miles per hour as you drove it around the track.

That’s speed.

VELOCITY:

“Velocity is a measure of how fast something moves in a particular direction.”

For example:

“If an object moves east at 9 meters per second (9m/s), then its velocity is 9 m/s to the east. Speed is one part of velocity; direction is the other part.”

Velocity on Wikipedia

So, in the racetrack example above, while you might have had an average speed of 97 MPH on the racetrack, your velocity was 0 m/s, because you ended up back where you started.

In other words, you went nowhere, fast.

That describes a car on a racetrack, and most potential small business buyers.

Velocity Vacuum

Velocity Vacuum

Tracy, our small business buyer, brags about her speed. But she, like most buyers, has a velocity of zero.

Since every prospect Tracy looks at ends up rejected (at least so far), all of the high-speed search activity just brings her back to where she started.

Like most buyers, Tracy generates no forward progress because her direction resets over and over and over again. In fact, online statistics suggest most buyers searching for a business to buy, will never buy a business at all.

All that speed takes them nowhere, because they have no velocity.

Sellers Zoom By

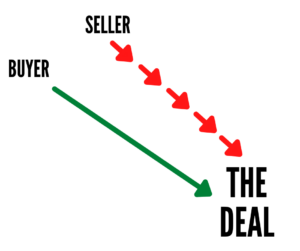

But here’s where a focus on early-stage buyer/seller velocity gets interesting. While our buyer is quick to complain about the seller’s slow speed, the seller almost certainly has a higher velocity than the buyer.

That occurs because every step (no matter how slow) the seller takes moves them towards their singular direction.

For example, if it takes Sue (the seller) three months to pull her financials together for Tracy, the work is critically important to Sue’s eventual sale – even if she never sells to Tracy.

So, while the seller might operate at a painstakingly slow speed, unlike the buyer, she has at least some velocity.

And it’s the clarity of direction that provides the seller’s velocity advantage.

One Direction

Nothing improves velocity like focus of direction. Sellers have it, and most buyers don’t.

Now let’s acknowledge something. Many (some would say most) small business sellers are bad at the “sell my business” thing. They sabotage deal potential in a variety of creative and self-destructive ways. Some just go downright crazy.

But even the “nutso” ones retain a clarity of direction. Their velocity benefits from the fact they have only one desired outcome:

I want to sell my business.

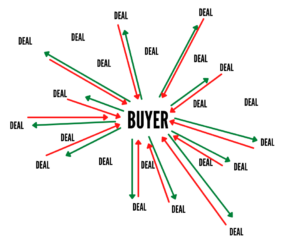

Directionless Buyers

Buyers think they have a similar, singular focus:

I want to buy a business.

But, that’s no direction at all, or maybe better said, it’s all directions at once for most buyers.

Have you heard buyers say things like. . .

Open to all possibilities.

I’m flexible.

Looking at different sorts of businesses.

Buyers say these things because they think being open to a variety of options will help them with their search. After all, if they are willing to look at anything, doesn’t that improve their odds of finding something? But all that “flexible” approach does is muddle their direction, which kills their velocity.

Why don’t buyers and sellers connect better in the early stage of a search? It’s not a difference in speed (although that’s an ingredient of the problem) the real challenge is the dramatic difference in velocity.

And much of that difference is a function of directionless buyers.

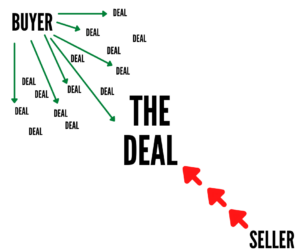

Buyers Must Pick a Direction

Buyers, this is how you increase your velocity: decide what kind of business you want to buy. Said another way . . .

I want to buy a business.

Needs to become . . .

I want to buy a carwash within 30 miles of my home.

That simple narrowing will dramatically focus your efforts and increase your velocity.

How?

How?

As the number of potential deals drops, you drive your time and efforts towards a much smaller range of potential outcomes. You’re focused towards a much narrower target, and you get much deeper into those prospects. This serves to align your direction with owners of companies in the space you want to be in. Your both heading to the same place.

Commonsense right?

Then what’s the problem?

The Problem is You Don’t Know What Kind of Business You Want to Buy

O.K. Fair enough. That’s a common reality for many searching buyers, and it’s important to be honest about that. But if that’s the case, you need to accept something that is both simple and very impactful.

Understand that until you decide what type of business you want to buy, you haven’t really started trying to buy a business.

Deciding what to buy needs to be a separate process from searching for that type of business. If you lump the two things together (deciding what to buy, and looking for it) you will almost certainly:

- Extend the length of time you spend searching.

- Increase your level of frustration.

- Destroy your velocity.

- Greatly diminish your chance to be successful in your search

Instead, buyers need to split the process into . . .

Two Distinct Steps

Step One: Decide what type of business you want to buy. Isolate for:

- Industry & Type of Business

- Size

- Geography

- Other key characteristics of your target business

Then, after you’ve narrowed your target and direction . . .

Step Two: Start trying to buy that kind of business.

With a focused search, you can orient all your efforts towards finding your target business. If it’s a carwash:

- You can research and get to know the details of the active carwash listings in your target market.

- You’ll get a better sense of prices, multiples, equipment type, variations, brokers who have those listings, etc.

- Very quickly, you’ll actually start to understand car washes as a business, what makes one successful, what are the hidden pitfalls, why do they get sold, what makes one sell faster or slower, etc.

“Wait,” you say. “There’s only a small handful of potential listings for sale when I limit the scope of my approach.” Fair enough, but consider . . .

Since you now know what type of business you want to buy, you can go off-market and create a list of every carwash in the market you are targeting – whether it’s for sale or not.

Since you now know what type of business you want to buy, you can go off-market and create a list of every carwash in the market you are targeting – whether it’s for sale or not.- Take owners to lunch and have conversations with them about the industry and start to find opportunities for purchase that aren’t listed for sale.

- Learn about the industry, the language owners use, and what makes a good or bad car wash business.

- Become a serious, respected, engaging prospective buyer for these targeted businesses, not just one of 1,000 quick hit artists speedily blowing past these owners.

While this focused effort will lower the number of listings you review, it will absolutely align your direction with the sellers you want to engage. Now both you and your potential sellers be headed towards the same desired destination, at similar speeds . . . velocity nirvana!

Velocity Wins

While this seems counter-intuitive, if you’re serious about buying a business, you need to slow down!

Take a moment. Pick a direction.

Focus your search.

It is one of the most important things a buyer can do to increase velocity and improve the odds of successfully buying a business.