What does an effective business for sale listing look like? We evaluate two online business listings and answer the question, “does it suck you in?”

Your online listing needs to “suck-in” potential buyers if you want to sell your small business. Does it make them want to learn more about your business? Does it invite them to pick up the phone and get the details?

We rate two listings in each post as follows:

Bad news – it doesn’t suck, because, in fact, it blows.

Bummer – It only sucks a little.

Not bad – it sucks pretty good.

Awesome – it really, really, sucks.

This time we’ll get the opinions of:

Matthew Buxton: Founder 8-Elements.com

Mike Finger, Founder Exit Oasis.com

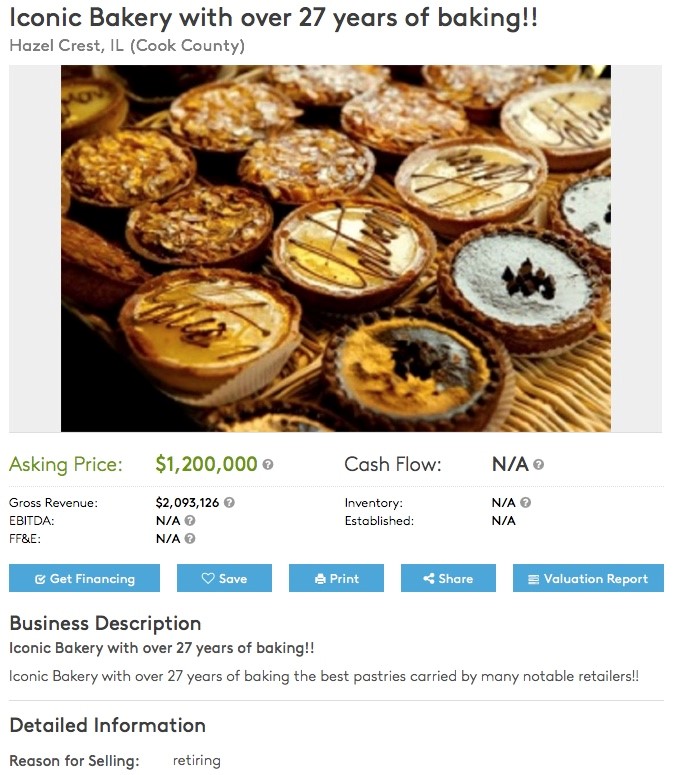

Listing #1:

Link: The Bakery Listing

Did We Get Sucked In?

Mike’s Opinion:  Bad news – it doesn’t suck; in fact, it blows.

Bad news – it doesn’t suck; in fact, it blows.

On this one we get a very brief, very incomplete listing for a bakery for sale in Hazel Crest, Ill. From the listing we learn this is an “Iconic Bakery with over 27 years of baking the best pastries carried by many notable retailers!!” That’s it. That’s all the narrative included in the listing.

This listing is ugly. We assume that the brief nature of the listing is motivated by the desire for confidentiality, which is a critical concern for a small business for sale. Unfortunately, this listing also gives the location as Hazel Crest, IL. 30 seconds on Google and you find that there’s only one bakery in Hazel Crest, and the website says it “opened its first location in the suburbs of Chicago over 28 years ago”.

Maybe we’ve got this wrong and it’s a different bakery for sale, in Hazel Crest, that’s been open 28 years . . . but we’re thinking this is broker oversight. In my opinion there is a lot of risk and no reward in making it easy to find this business. Some businesses decide to go public with their sale despite the risk, and that is a legitimate strategy choice. But to throw out a listing like this . . . what’s the point? No wonder business owners hide from brokers.

If I’m interested as a buyer, I’m not going to call the broker, I’m going to head down to the bakery. Check it out myself. Maybe I’ll buy a loaf of bread, or a doughnut.

Doughnuts are good – this listing isn’t.

Matt’s Opinion: Bummer – It only sucks a little.

Matt’s Opinion: Bummer – It only sucks a little.

Boy o boy a bakery for $1.2 million, you don’t see that very often.

I have to agree with you Mike, from the very limited information it would appear the business can be easily identified. (Not good for the business being sold and really not good for that representative listing the business for sale).

Given the price point and given this is clearly a large seasoned business, this would have been a golden opportunity for the business representative to showcase this business (without disclosing who they were).

It would have been an opportunity to clearly explain “why” this business is worth $1.2 million.

This is a really bad business listing and sadly one that will negatively impact the owner(s) selling, in several different ways.

__________________

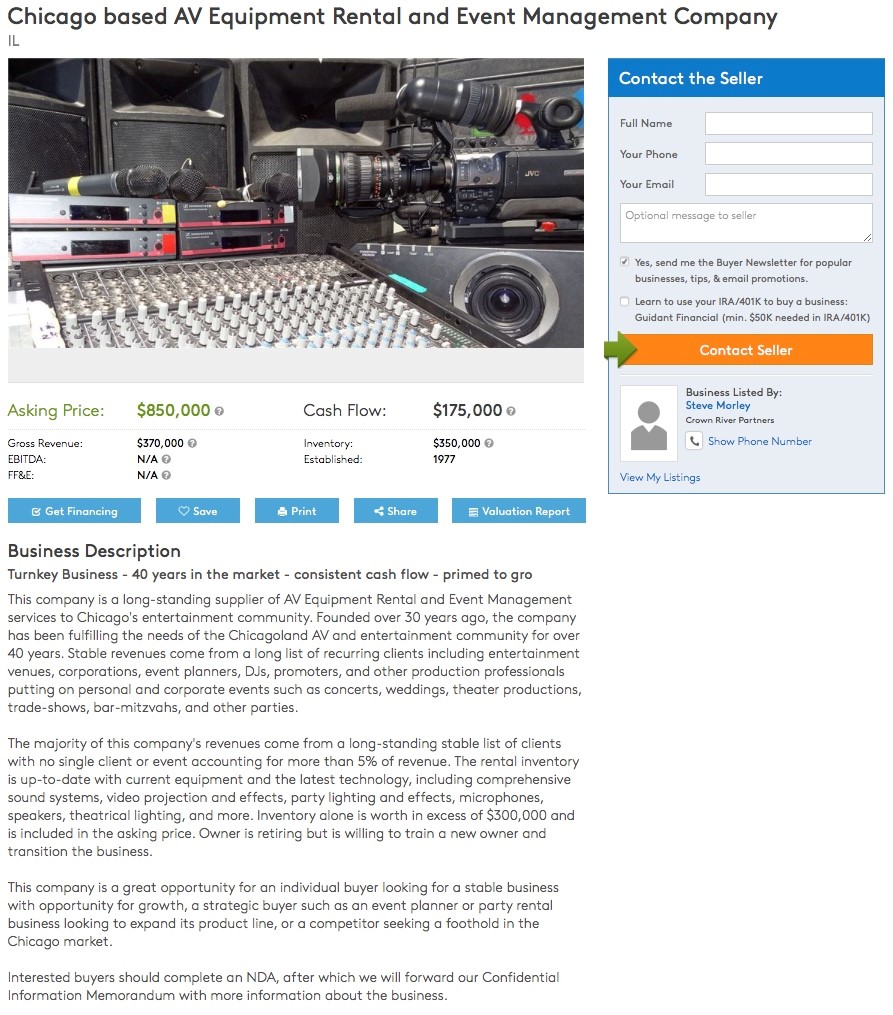

Listing #2:

Link: AV Equipment Rental Listing

Did We Get Sucked In?

Matt’s Opinion: Awesome – it really, really, sucks.

I like this business listing. Care and effort was put into creating it by the business listing representative.

I like the fact it has all the information you would initially want to know about a business opportunity. They even take the time to comment on the Competition and Growth & Expansion which you rarely see.

I particularly like the fact it explains what you need to do if you are interested: “Interested buyers should complete an NDA, after which we will forward our Confidential Information Memorandum with more information about the business.” The NDA is also attached to the ad for convenience.

For me I’m not so concerned about the multiple. Because although it’s high at 4.8, there might be a chance it is a good 3.5 times once you sink your teeth into the information.

I wish you saw more business listings of this quality. If I were a potential buyer, I’d definitely complete the NDA and contact the business representative!

Mike’s Opinion: Not bad – it sucks pretty good.

The listing provides a good overview of the business and gives some answers to key questions like customer concentration, equipment value, and whether the old owner will stick around. A lot of information without revealing too much about the business.

From a content perspective this is a strong listing. The only reason I didn’t give this one the “three vacuum treatment” is the price to cash-flow. This is a rental business. The equipment inventory is worth $350,000 and is included in the sale. Here’s the problem. The price and cash-flow put the multiple of this business at 4.8 – well above the national average of 2.5 for a small business. Why is it worth that? Because if you pull out the cost of the equipment the asking price is a 2.8 ratio, but without the equipment to rent, your income disappears. I thought they could have addressed that in the listing a little more directly.

Solid listing, worth a call, but ask about the price.

__________________

Does it suck? You decide. Add your comments and opinions below. Have a listing you would like reviewed (and promoted) drop a link in the comments below, or contact the reviewers at their websites listed above.